Extract Airline Data for Post-Crisis Strategy to Accelerate Market Recovery

Introduction

The aviation industry has faced repeated disruptions over the past decade, ranging from global health emergencies to geopolitical instability and fuel price volatility. In such an environment, airlines must rely on data-backed insights rather than intuition to rebuild profitability, optimize routes, and restore traveler confidence. The ability to systematically extract Airline Data for Post-Crisis Strategy has emerged as a foundational requirement for sustainable recovery planning.

To support informed decision-making, airlines increasingly depend on Airline Data Scraping Services that collect large-scale pricing, scheduling, capacity, and demand signals from global booking platforms. These datasets enable carriers to identify structural market shifts rather than temporary anomalies.

At a strategic level, Post-Crisis Airline Market Intelligence empowers airlines to compare recovery trajectories across regions, benchmark competitors, and prioritize investments that align with evolving passenger behavior.

The Role of Airline Data in Post-Crisis Recovery

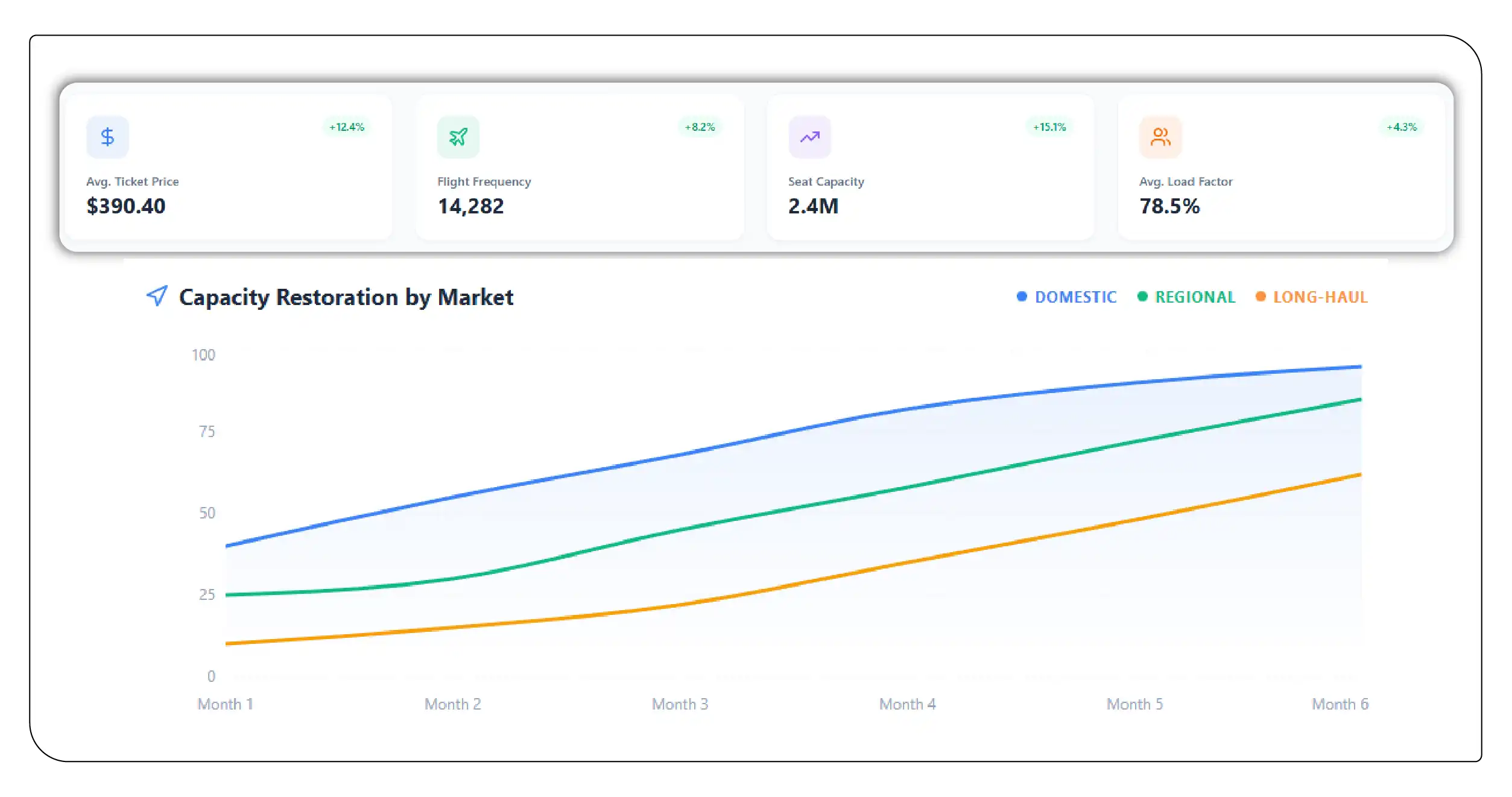

Post-crisis recovery is rarely linear. Passenger demand often returns unevenly across domestic, regional, and long-haul routes. Business travel recovers at a different pace than leisure travel, while price sensitivity varies sharply by geography. Airline data offers visibility into these complex patterns.

Key recovery metrics include:

- Average ticket price fluctuations

- Seat capacity restoration rates

- Frequency of flight operations

- Route-level demand resurgence

- Load factor normalization timelines

Analyzing these indicators together allows airlines to determine which markets warrant aggressive re-entry and which require a cautious, cost-controlled approach.

Price Volatility and Demand Signals

One of the most valuable assets in recovery planning is a Global Flight Price Trends Dataset. This dataset reveals how fares behave before, during, and after crisis periods across different regions and cabin classes.

Price data helps airlines:

- Detect early demand rebounds

- Identify markets where price elasticity is highest

- Avoid underpricing during recovery surges

- Adjust yield management models dynamically

In many cases, airlines that recovered fastest were those that closely tracked competitor pricing movements and aligned their fare strategies accordingly.

Data Collection Through Web Intelligence

Modern recovery strategies increasingly rely on Web Scraping Airline Data for Market Recovery to monitor real-time changes across online travel agencies, airline websites, and meta-search platforms. These sources provide continuous updates on fares, schedules, seat availability, and promotional activity.

Web-based data collection supports:

- Rapid response to competitor fare changes

- Identification of emerging travel corridors

- Detection of capacity mismatches

- Short-term forecasting of demand spikes

This approach allows airlines to move from reactive planning to proactive recovery management.

Table 1: Sample Post-Crisis Flight Price Recovery Trends

| Region | Avg Fare (Crisis Period) | Avg Fare (12 Months Later) | % Price Change | Demand Recovery Index |

|---|---|---|---|---|

| North America | USD 210 | USD 275 | +31% | 0.92 |

| Europe | USD 185 | USD 240 | +29% | 0.88 |

| Asia-Pacific | USD 160 | USD 225 | +41% | 0.85 |

| Middle East | USD 230 | USD 295 | +28% | 0.90 |

| Latin America | USD 170 | USD 215 | +26% | 0.83 |

Interpretation: Regions with higher leisure travel dependency showed faster price normalization, while business-heavy corridors recovered more gradually.

Pricing Intelligence and Revenue Optimization

Effective recovery depends on transforming raw data into Flight Price Data Intelligence. This involves layering historical trends, competitor benchmarks, and demand indicators into predictive pricing models.

Key benefits include:

- Optimized fare buckets during recovery phases

- Reduced revenue leakage from premature discounting

- Improved alignment between capacity and demand

- Smarter promotional timing

Airlines using advanced analytics were better positioned to restore margins without sacrificing load factors.

Advanced Analytics for Strategic Planning

Beyond pricing, Post-Crisis Flight Market Data Analytics integrates multiple datasets—prices, schedules, passenger volumes, and route frequencies—to generate holistic recovery insights.

These analytics support:

- Route reinstatement prioritization

- Fleet utilization optimization

- Hub-and-spoke network recalibration

- Regional recovery comparison

This multidimensional approach ensures that recovery decisions are based on evidence rather than assumptions.

Table 2: Route-Level Capacity and Frequency Recovery Analysis

| Route Type | Pre-Crisis Weekly Flights | Crisis Low Point | Current Flights | Capacity Restored (%) |

|---|---|---|---|---|

| Domestic Short-Haul | 1,250 | 420 | 1,080 | 86% |

| Regional Medium-Haul | 820 | 260 | 640 | 78% |

| Long-Haul Intl. | 610 | 150 | 430 | 70% |

| Tourism-Focused | 540 | 180 | 470 | 87% |

| Business Corridors | 690 | 210 | 480 | 69% |

Insight: Leisure-driven routes recovered faster than corporate travel corridors, reinforcing the need for differentiated recovery strategies.

Competitive Benchmarking After Crisis

A critical component of recovery planning involves post-crisis airline benchmarking insights, which allow airlines to evaluate their performance relative to peers. Benchmarking highlights gaps in pricing, capacity restoration, and network expansion.

This comparative view enables leadership teams to:

- Identify overexposed markets

- Adjust recovery speed strategically

- Reallocate aircraft efficiently

- Improve competitive positioning

Operational Scheduling and Network Stability

Accurate schedule data remains essential during volatile recovery periods. Monitoring the Global Flight Schedule Dataset allows airlines to assess operational stability across regions and identify markets with consistent frequency growth.

Schedule intelligence helps avoid:

- Over-scheduling in weak demand zones

- Under-serving rapidly recovering routes

- Aircraft idle time inefficiencies

Conclusion

Data-driven recovery is no longer optional—it is a strategic necessity. Airlines that succeed in long-term stabilization are those that invest in airline recovery comparison analytics and continuously refine their strategies using real-world signals.

By systematically extracting airline data for post-crisis planning, airlines gain clarity on pricing behavior, demand recovery, and competitor movements. The integration of datasets such as the Airline Price Change Dataset ensures that recovery decisions remain grounded in measurable trends rather than short-term optimism.

Ultimately, data-centric recovery strategies enable airlines to emerge from crises not just restored, but structurally stronger, more agile, and better prepared for future disruptions.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.

.webp)

.webp)