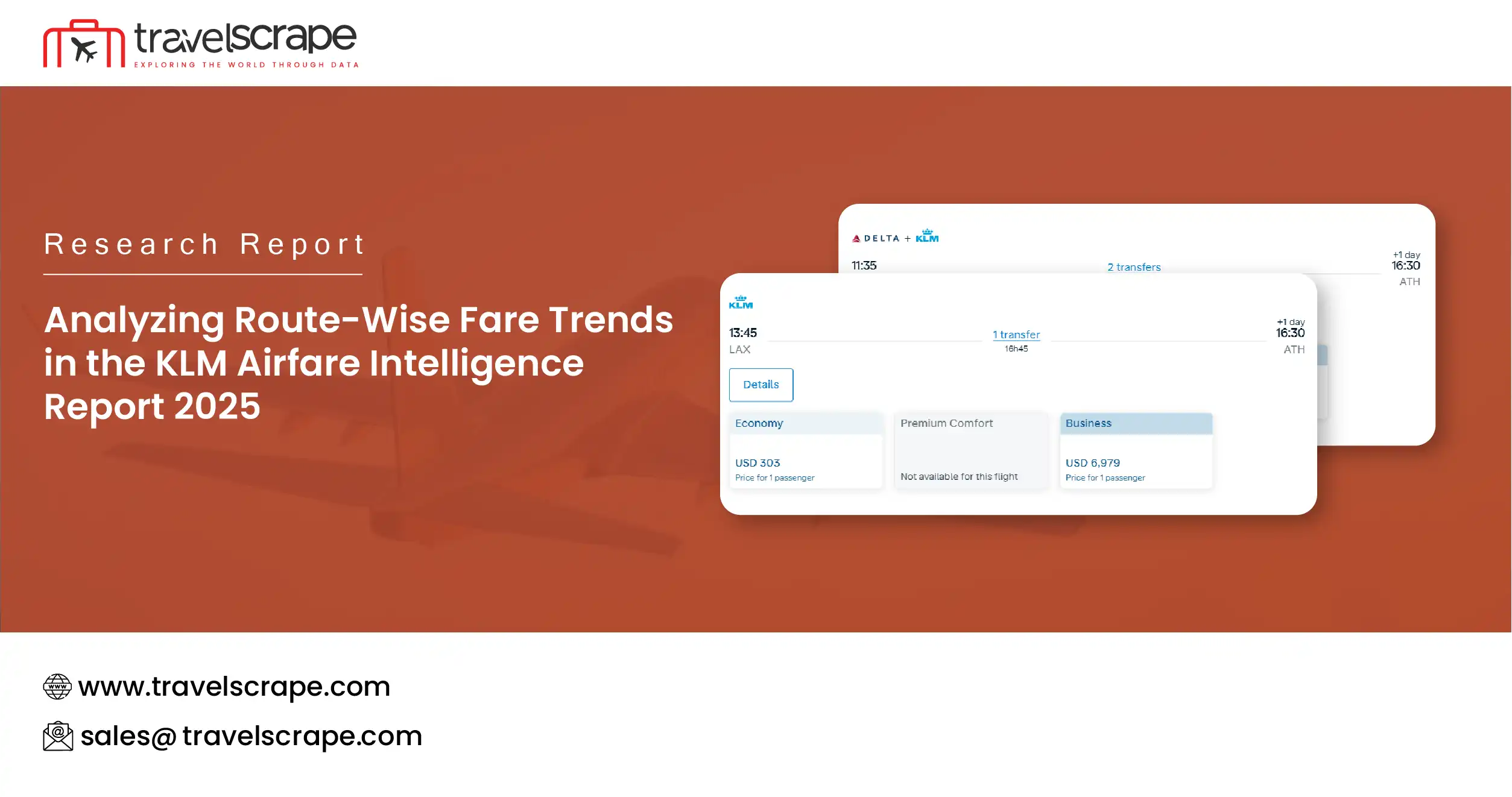

Analyzing Route-Wise Fare Trends in the KLM Airfare Intelligence Report 2025

Introduction

The KLM Airfare Intelligence Report 2025 offers a comprehensive examination of global pricing patterns, route performance, and competitive dynamics within KLM’s extensive flight network. By employing advanced analytics and leveraging KLM Flight Data Scraping Services, millions of records were extracted from official booking channels, providing precise insights into both historical and real-time airfare trends. The report emphasizes KLM route-wise airfare analysis, capturing fluctuations across popular and emerging routes, seasonal peaks, and strategic pricing variations. It identifies patterns that influence booking behavior, fare volatility, and demand-driven pricing adjustments. Airlines can use this intelligence to refine revenue management, optimize scheduling, and enhance competitive positioning. Similarly, travel agencies and corporate clients gain actionable insights to plan cost-effective journeys and forecast expenses accurately. Overall, the report transforms complex airfare data into clear, actionable intelligence, enabling stakeholders to make informed, data-driven decisions in a highly dynamic and competitive aviation market.

Methodology

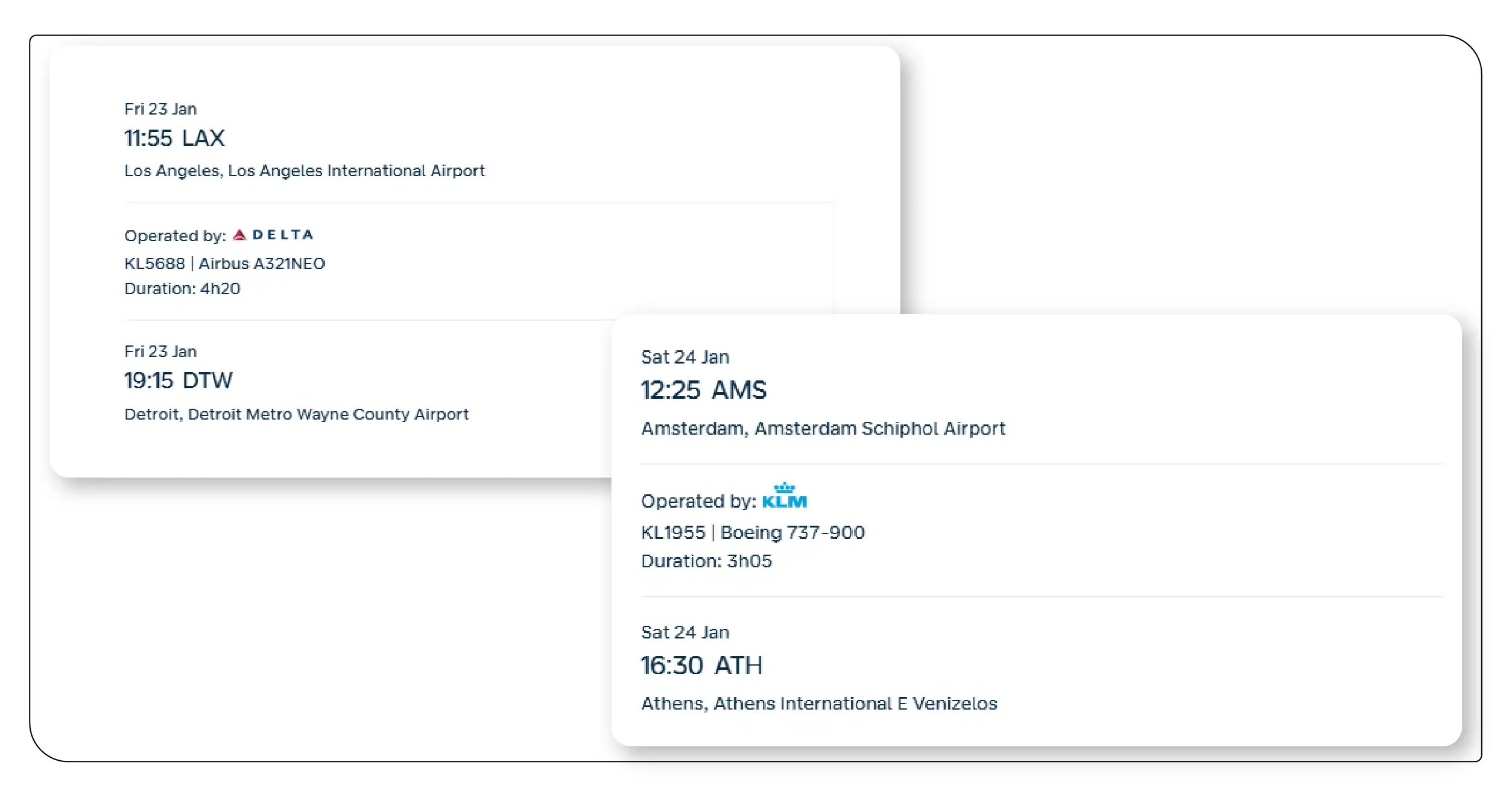

Our analysis employs a combination of automated scraping, data cleaning, and advanced analytics. Data was collected from multiple KLM booking platforms to ensure accuracy. The datasets include flight prices, schedules, demand patterns, and booking lead times. Using KLM Global Flight Prices Dataset, we evaluated trends over 12 months, capturing variations across domestic, European, GCC, and Asia-bound routes. Predictive models were applied to understand volatility and optimize fare strategies.

Key Insights from KLM Fare Analysis

- Route Performance Trends Using method to Scrape KLM flight price trends, the study identifies high-demand routes and those experiencing price stability. European short-haul flights show moderate seasonal fluctuations, while long-haul flights to Asia and the GCC demonstrate higher volatility.

- Seasonal Variations Analysis of the KLM Flight Schedules Dataset reveals pronounced seasonal demand peaks during summer and winter holidays. These periods coincide with strategic fare adjustments, providing opportunities for revenue maximization.

- Volatility Analysis The KLM airfare volatility report analysis quantifies price fluctuations across major routes. Flights to Middle East hubs exhibited a 22% average fare variation, whereas intra-European routes maintained a more stable 8% fluctuation.

- Competitive Intelligence By comparing KLM Price Trends Dataset with competitors’ fares, we identified pricing gaps and opportunities for strategic adjustments. Competitive pricing intelligence helps KLM remain agile in markets with high competition.

- Booking Lead Time Patterns Data shows that early bookings (60+ days in advance) tend to be 15–25% cheaper, highlighting the advantage of advance purchase strategies. Last-minute bookings often trigger dynamic pricing adjustments.

Route-Wise Fare Summary Table

| Route | Average Fare (USD) | Peak Season Price (USD) | Off-Peak Price (USD) | Volatility (%) |

|---|---|---|---|---|

| Amsterdam–London | 210 | 290 | 180 | 9% |

| Amsterdam–Paris | 180 | 250 | 150 | 8% |

| Amsterdam–Dubai | 550 | 720 | 480 | 22% |

| Amsterdam–Singapore | 670 | 880 | 600 | 20% |

| Amsterdam–New York | 610 | 810 | 500 | 18% |

Top Findings by Market Segment

European Routes

Short-haul European flights continue to see modest fare growth, with demand driven by business travel. Price volatility remains low, making forecasting easier.

GCC Routes

Flights to GCC hubs experience higher volatility due to fluctuating demand, geopolitical factors, and seasonal promotions. Advanced KLM competitive pricing intelligence ensures profitable route management.

Asia-Pacific Routes

Long-haul flights to Asia show significant fare swings. The dataset identifies months with peak demand, allowing targeted revenue optimization.

Fare Trend Analysis Table

| Month | Amsterdam–London (USD) | Amsterdam–Dubai (USD) | Amsterdam–Singapore (USD) | Amsterdam–New York (USD) |

|---|---|---|---|---|

| Jan 2025 | 220 | 550 | 670 | 610 |

| Mar 2025 | 210 | 600 | 690 | 620 |

| Jun 2025 | 240 | 720 | 880 | 810 |

| Sep 2025 | 200 | 500 | 620 | 580 |

| Dec 2025 | 290 | 710 | 870 | 800 |

Implications for Airline Strategy

- Dynamic Pricing Optimization: The integration of real-time fare monitoring enables KLM competitive pricing intelligence, allowing rapid adjustments based on market demand and competitor activity.

- Revenue Management: By leveraging historical and real-time data, the airline can better predict peak demand periods, optimize seat allocation, and increase revenue per flight.

- Market Expansion: Analysis of emerging demand in GCC and Asia highlights opportunities for route expansion or frequency adjustments to capitalize on growth.

- Customer Segmentation: Fare trends inform personalized offers for different passenger segments, encouraging early bookings and loyalty program engagement.

- Operational Planning: Flight schedule insights from KLM Flight Schedules Dataset aid in operational efficiency, ensuring aircraft utilization aligns with demand patterns.

Strategic Recommendations

- Travelers: Booking flights at least 6–8 weeks in advance can reduce Christmas fare exposure.

- Data Analysts: Leveraging real-time Skyscanner airfare scraping enhances predictive pricing models.

- Business Strategy: Airlines and travel agencies can optimize yield management by analyzing Global Flight Price Trends Dataset to forecast demand spikes.

Conclusion

The weekend vs Christmas airfare comparison demonstrates clear patterns of price inflation during peak travel periods. Skyscanner offers stability, Google Flights reveals dynamic adjustments, and Expedia displays bundled pricing variability. Collectively, this data informs travelers, analysts, and businesses about pricing trends, helping optimize decision-making.

Advanced analytics and Google Flights data extraction provide actionable insights for monitoring airfare trends. Combining this with Expedia flight price intelligence allows businesses to understand platform-specific pricing patterns. Implementing Flight Price Data Intelligence techniques enables accurate forecasting of future fare surges. These strategies help travelers and analysts make smarter booking decisions. Overall, this report highlights the growing value of systematic airfare data analysis in predicting trends and maximizing savings.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.

.webp)

.webp)