2025–2026 Airfare Price Forecast: Worldwide Volatility & Market Overview

Introduction

The global aviation ecosystem is undergoing one of the most unpredictable pricing cycles in recent history, influenced by fluctuating fuel costs, evolving passenger demand, seasonal route disruptions, and aggressive AI-based ticket pricing models. The 2025–2026 Airfare Price Forecast indicates that air ticket pricing over the next 12 months will experience higher volatility than 2023–2024 averages, driven significantly by Machine-Learning revenue optimization strategies. With the rising need for granular and real-time dataset monitoring, enterprises are increasingly leveraging Airline Data Scraping Services to predict fare variations and reduce procurement-level risk exposure. Using web-based fare extraction models and historical trend benchmarking, a structured and data-rich approach enables firms to build accurate Monthly flight price trend forecast models for the upcoming year.

The report emphasizes the need for seamless system integrations, broader market visibility, and intelligent computational layers enabling enhanced industry foresight. Moving ahead, we recommend prioritizing technology-backed capabilities for itinerary cost evaluation to refine booking windows and assess competitive disruptions. Incorporating tools designed for automated fare analysis and competitive visibility will reshape how the aviation market functions across planning and procurement horizons.

Overview of the Global Airfare Volatility Outlook

The worldwide aviation sector is projected to exceed pre-COVID capacity levels by Q2-2025. However, fare unpredictability continues due to unstable oil markets, route optimization decisions, shifting tourism behavior, and global airport taxation reforms. The deployment of Big Data-powered analytical tools supports large-scale processing of structured and unstructured ticketing and availability feeds. Moreover, the ability to integrate diverse route-wise datasets, including real-time booking logs and historical pricing cycles, fosters meaningful benchmarking of the Global Flight Price Trends Dataset for enterprise planning.

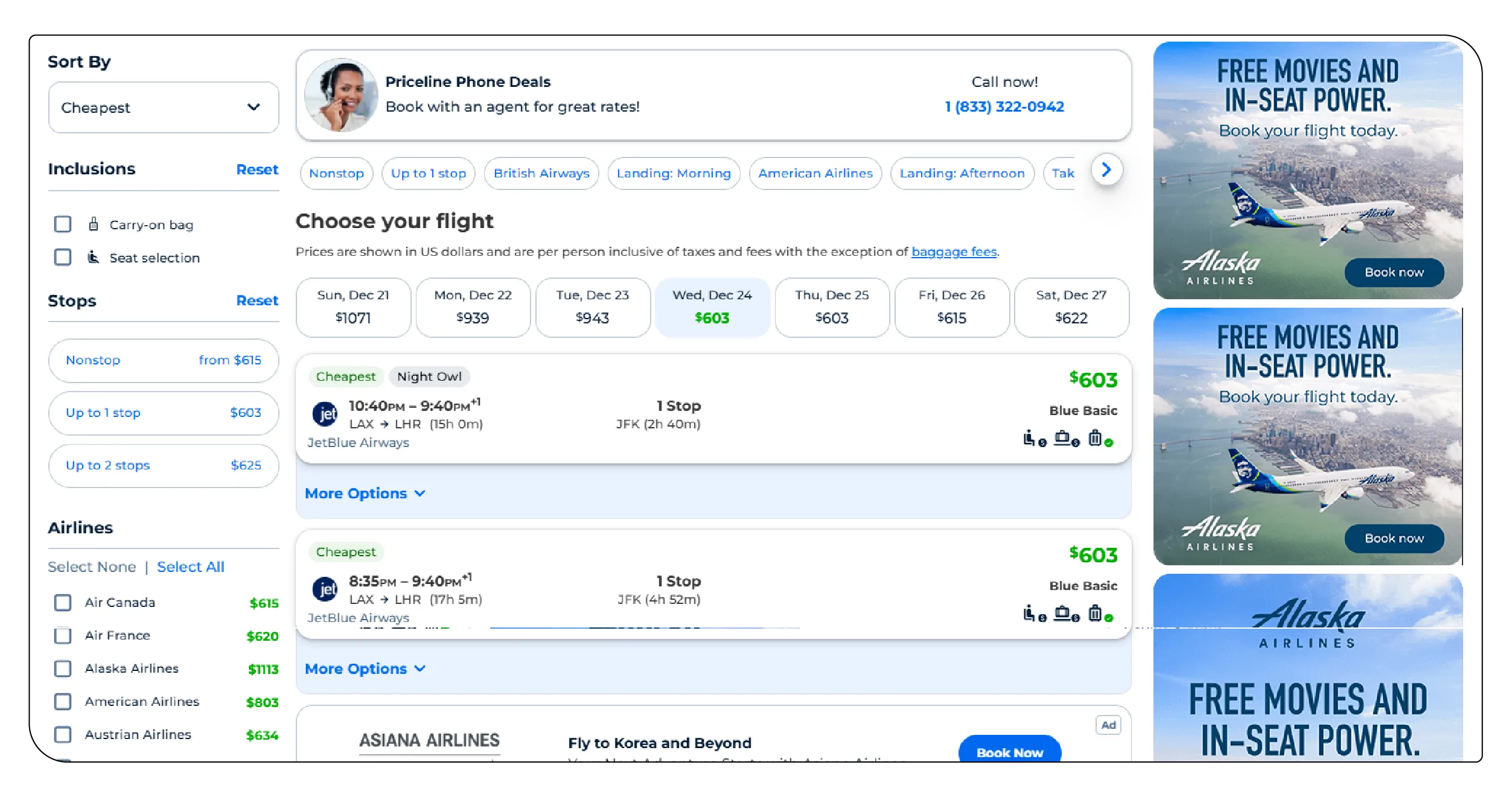

Airlines are now increasingly relying on algorithmic yield management and AI-generated pricing, commonly known as Real Time Airline dynamic pricing, where ticket costs alter several times per day based on variables such as load factor, surge timing, user geolocation, past search patterns, and booking window behaviors.

Market Drivers Influencing 2025-2026 Flight Prices

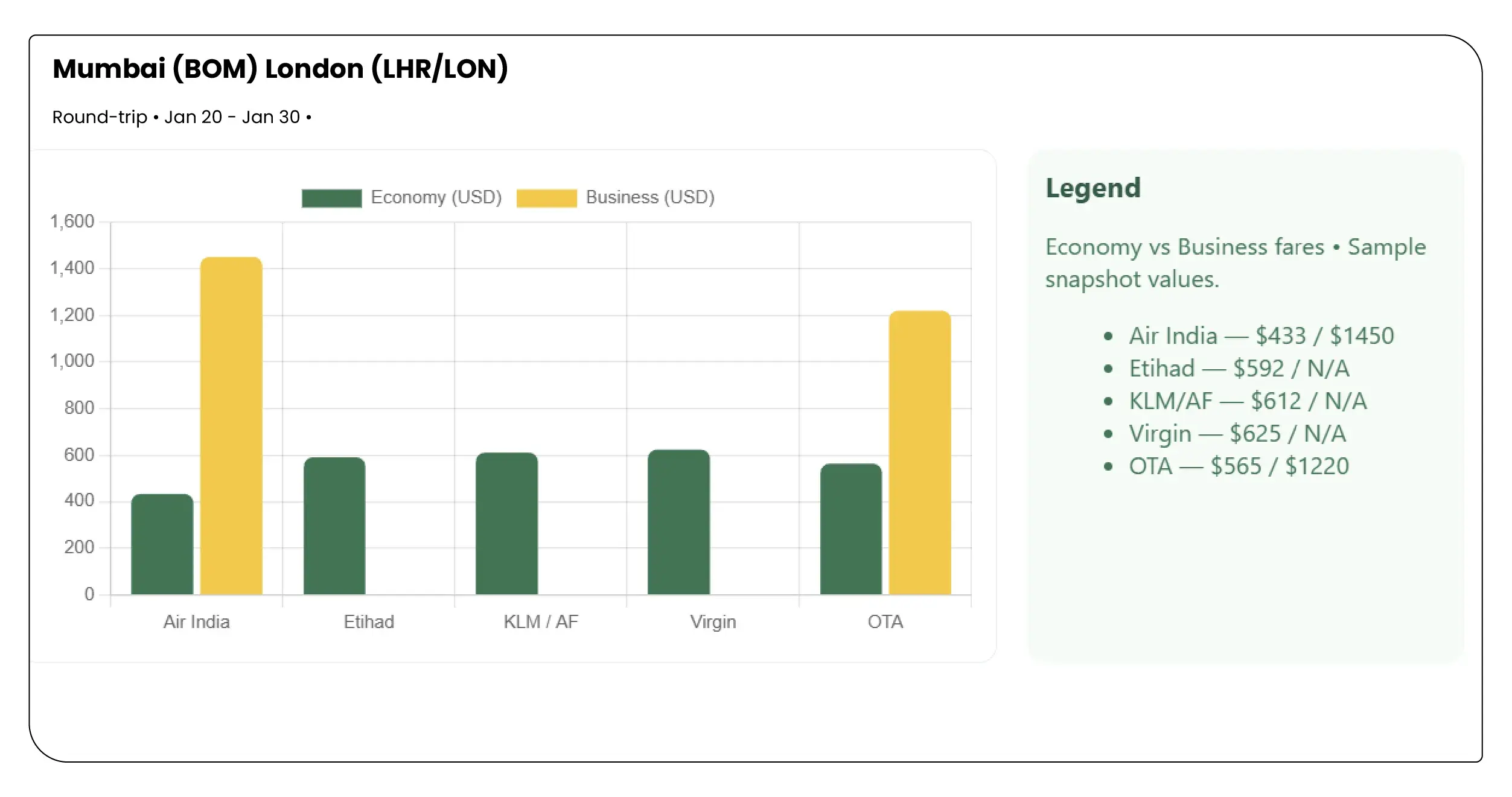

Modern pricing engines capitalize deeply on next-generation Flight Price Data Intelligence to execute price segmentation and maximize per-seat revenue. Corporate travel managers and airline procurement teams require precise visibility on rate fluctuations across international and domestic routes to optimize booking budgets. Price benchmarking dashboards built on continuous Historical flight price scraping help uncover route seasonality and interaction patterns between supply and demand cycles.

Evaluating technical parameters, including booking horizon, baggage integration, fare family breakdown, and operational route performance, helps identify pricing anomalies, last-minute dynamic fluctuations, and seasonal premium windows. Moreover, passenger search and purchase behavior trends contribute significantly to forecast model accuracy.

2025-2026 Strategic Pricing Forecast – Key Observations

From the research analysis and multi-platform fare comparison insights, the following pricing forecast highlights stand out:

- Q1-2025 will witness increased seasonal price sensitivity due to high leisure demand across major travel corridors.

- Q3-2025 pricing is expected to spike due to tourism peak, geopolitical travel uncertainty, and capacity restrictions.

- Low-cost carriers will introduce more dynamic and segmented pricing structures.

- Business travel recovery will add pressure on premium cabin fares.

- Airlines will continue vertical unbundling—charging separately for cabin options and services.

The rise of Airfare Fluctuation Data Scraping helps stakeholders manage exposure to sudden fare inflation. Travel consolidators and booking platforms increasingly integrate cross-market pricing engines to Scrape Airline ticket price comparison insights for tactical decision-making.

Table 1 – Predicted Average Fare Variation by Route Category (2025–2026)

| Route Segment | Avg Fare Change Forecast | Key Driver | Seasonal Impact Level |

|---|---|---|---|

| Domestic – Short Haul | +8% | Fuel & Tax Adjustments | Medium |

| Domestic – Long Haul | +11% | Demand Rebound | High |

| International – Regional | +14% | Airport Tariff Pressure | High |

| Intercontinental Premium Routes | +18% | Corporate Travel Spend | Very High |

| Low-Cost Economy Routes | +6% | Competitive Pricing | Low |

Role of Technology & Scraping-Based Forecasting Models

The modernization of travel pricing intelligence systems requires advanced automated web-based data collection. Distributed extraction engines enable detailed multi-platform tracking and segmentation of competitor fares. Leveraging machine-learning systems on top of automated airline datasets enables adaptive pricing projections and real-time model recalibration.

With API-based fare capturing, AI-ML analytics supports 12-month volatility simulation logic. Automated scraping agents track competitive behavior by evaluating cabin loads, weekday vs weekend spikes, airline promotional windows, and special demand cycles. This provides analytical clarity unavailable via manual observation.

Table 2 – Example Monthly Flight Fare Volatility Simulation (Sample Data)

| Month 2025–2026 | Avg Fare Index (Baseline 100) | Forecast Volatility % | Key Influence |

|---|---|---|---|

| Jan-2025 | 112 | 9.5% | New Year Demand |

| Mar-2025 | 118 | 11.2% | Spring Tourism |

| Jun-2025 | 126 | 14.8% | Summer Peak |

| Sep-2025 | 109 | 10.6% | Seasonal Dip |

| Dec-2025 | 134 | 17.4% | Holiday Surge |

Future Landscape of Airline Pricing Intelligence & Revenue Strategy

AI-based dynamic pricing systems will expand significantly in 2026, empowering carriers to combine revenue forecasting with personalized demand targeting. Using technology-supported pricing engines, airlines can predict willingness-to-pay and customize fare restructuring at micro-segments. This is particularly valuable for government aviation planners, airline revenue strategists, travel marketplace operators, and corporate sourcing teams.

Competitor intelligence systems integrate global markets and extract flight schedule alignment, event-based price shocks, and national tourism policy decisions. Analysts use micro-data-driven KPIs such as elasticity ratios, pricing boundary tolerance and purchase acceleration speed to predict future surges.

The future of commercial aviation market intelligence revolves around layered automation, execution speed, and structured affordability models.

Conclusion

The accelerating complexity of airfare management and ticketing fluctuations reinforce the critical importance of automated dataset collection, cross-route benchmarking, and predictive modeling. For travel enterprises, corporate mobility units, and airline procurement strategists, adopting automated fare extraction provides a competitive advantage driven by actionable dashboards rather than reactive decisions. The application of large-scale scraping architecture supports smarter travel pricing decisions and strengthens long-term forecasting ecosystems. With expanding Global Flight Schedule Dataset, advanced data models can enhance prediction accuracy, optimize cost allocation, and reduce budget exposure for organizations dependent on frequent large-volume travel. Automation-centered forecasting continues to set a new operational performance standard supported by scalable 12-month volatility analytics.

To achieve better industry preparedness through continuous analytical insights and structured data acquisition workflows, large-scale travel data infrastructure will become essential. Therefore, leveraging Web scraping airline fare tracking and scalable aviation analytics frameworks contributes directly to exponential improvement of airline price market intelligence systems powered by multi-source accuracy.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.

.webp)

.webp)